Chicago, July 14, 2025 (GLOBE NEWSWIRE) --

The demand for affordable personal loans in the United States has increased dramatically in mid-2025. As inflation pressures households and more consumers seek emergency funds, online lending platforms that offer streamlined, low-interest loan access are stepping in to fill the gap. Heart Paydays is one such platform now experiencing accelerated demand from borrowers across the country.

Market Trends in Personal Lending (2025)

Recent consumer lending reports show that U.S. households are turning to unsecured personal loans more frequently to cover rising expenses in 2025. Loan applications for amounts between $1,000 and $5,000 have increased over 30% compared to the same period last year, particularly in mid-sized cities and rural regions underserved by traditional banks. Digital loan platforms are leading the charge in meeting this demand.

Fintech lenders are capitalizing on improved underwriting algorithms, mobile-optimized interfaces, and automated compliance to bring near-instant approvals to the mass market. Analysts tracking financial behavior in 2025 forecast that digital personal loans will exceed $270 billion globally by year-end, a sign that borrowers are actively moving away from legacy credit channels.

Consumer Behavior Shifts: Why Low Interest Loans Are in Demand

Borrowers today are more cautious. They want transparent lending terms, fast disbursements, and lower overall borrowing costs. Traditional payday loans and credit cards often carry high APRs, while low-interest personal loans are being seen as a smarter option for those needing fast, flexible financing.

Economic pressures, including delayed wage growth and rising housing costs, are also driving U.S. consumers to seek manageable debt with predictable repayment. According to recent search data, interest in "low interest personal loans near me" and "fast emergency loan approval" rose 47% in Q2 2025 across mobile platforms.

What Is a Low Interest Personal Loan?

A low interest personal loan refers to an unsecured loan with a below-average annual percentage rate (APR). These loans typically have fixed interest rates and repayment terms between 6 and 24 months. While actual rates vary based on creditworthiness and lender policies, platforms like Heart Paydays help consumers access offers that may be more affordable than legacy borrowing options.

Borrowers can often select from multiple offers and tailor repayment options to match their monthly income cycle, rather than being forced into short-term balloon repayment schemes. This flexibility, combined with automated loan processing, makes personal loans a viable safety net for many in 2025.

The Rise of Mobile-First Lending Platforms

Over 76% of loan applications on Heart Paydays are now submitted via mobile devices. Consumers want to apply, get approved, and receive funds—all without visiting a bank. This shift toward mobile-first lending reflects larger changes in how Americans manage their personal finances.

The frictionless experience of applying online—without paperwork, branch visits, or intrusive interviews—is no longer a novelty. It's an expectation. Borrowers rank speed of funding and privacy as two of the most important criteria when choosing a lending platform.

Heart Paydays Platform Overview

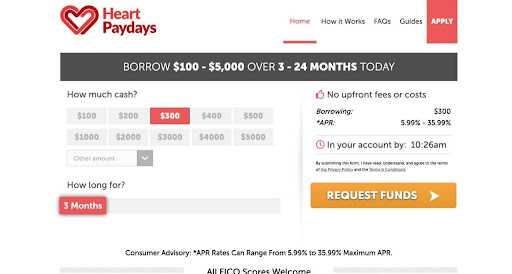

Heart Paydays is a digital loan connection service that matches U.S. borrowers with third-party lenders. The platform is designed for speed, security, and accessibility. It supports applicants with fair to poor credit and provides multiple repayment term options.

Unlike direct lenders, Heart Paydays allows users to compare pre-qualified offers from a wide network of financial institutions in a single session. This minimizes unnecessary credit inquiries and provides a streamlined route to the most appropriate funding options.

Key Features and Benefits

- Loan amounts up to $5,000

- Repayment terms up to 24 months

- Access for credit scores as low as 580

- Fast approvals and disbursements

- No collateral required

- Mobile-optimized application process

- Secure encryption of personal data

- Transparent borrowing without hidden fees

Borrower Profiles

The platform primarily serves employed adults aged 25–55 who have monthly income but may not qualify for traditional bank loans. Many users are gig workers, renters, or small business owners who need liquidity quickly.

Demographic data from Heart Paydays indicates that a majority of users fall within the $35,000–$75,000 annual income range, with the highest loan demand clustered in states like Texas, Ohio, Florida, and Georgia. Suburban and exurban areas now outpace urban centers in application volume, reflecting a broad shift in borrowing needs across income levels.

Use Cases

Common uses for these loans include:

- Emergency medical expenses

- Home and car repairs

- Rent or utility coverage

- Debt consolidation

- Job relocation and moving expenses

- Bridge financing between paychecks

- Education-related purchases or expenses

Loan disbursement data from Heart Paydays shows that over 40% of loans issued in June 2025 were for $3,000 or less, suggesting the platform plays a vital role in mid-sized expense management.

Step-by-Step Application Process

- Visit Heart Paydays

- Fill out the secure application form

- Review loan match(es)

- Accept offer (if eligible)

- Funds deposited in as little as 24 hours

Applicants are encouraged to verify details such as APR, fees, and prepayment terms before proceeding. Approval timelines vary depending on lender response time and applicant documentation.

Eligibility Requirements

- Must be 18+ and a U.S. resident

- Valid checking account and income source

- Mobile number or email address

Eligibility does not guarantee approval. Qualification depends on additional factors including lender criteria, repayment history, and reported income stability.

Loan Terms and Repayment

Borrowers choose from flexible terms ranging from 3 to 24 months. Fixed monthly payments help users manage repayment and avoid the ballooning interest common with other products.

Repayment calculators are available on lender sites to help users estimate their monthly dues based on loan amount, term length, and interest rate. Late payment fees, if any, are disclosed prior to acceptance of any loan offer.

Credit Score Flexibility

Unlike banks, Heart Paydays works with borrowers who may have a credit score in the 580–680 range. The platform emphasizes ability to repay over credit history alone.

This accessibility opens up financial options for users who may have limited credit histories, recent setbacks, or thin files. In many cases, borrowers improve their credit profiles over time by responsibly managing and repaying loans initiated through Heart Paydays’ network.

Financial Literacy Tips

- Always compare loan terms before accepting

- Avoid borrowing more than you need

- Build repayment into your monthly budget

- Set reminders to avoid late fees

- Monitor your credit after funding

- Beware of automatic renewals or extensions not explicitly agreed upon

Borrowers are encouraged to use loan offers as financial bridges—not long-term dependencies. Responsible borrowing supports both short-term relief and long-term stability.

Pros and Cons of Low Interest Loans

Pros:

- More affordable than credit cards

- No collateral required

- Builds credit when paid on time

- Predictable payments with no revolving balance

Cons:

- Interest rates may still be high for subprime borrowers

- Missed payments can harm credit

- Not suitable for long-term financial gaps

- May include origination or late fees depending on the lender

Frequently Asked Questions

Can I get approved with bad credit? Yes, many borrowers with fair or poor credit are approved daily.

Are there fees? Some lenders may charge origination or late fees. Read all terms.

How soon can I receive the funds? Often within 24 hours of approval.

Will this affect my credit score? Checking offers typically uses a soft credit pull. Acceptance of an offer may trigger a hard inquiry.

What loan amount can I qualify for? Most offers range from $300 to $5,000 depending on income and creditworthiness.

Regulatory Considerations and State-by-State Lending Variance

Loan availability and terms can vary significantly based on the borrower’s state of residence. Each U.S. state sets its own regulations for maximum allowable interest rates, minimum loan amounts, and licensing requirements for third-party lenders. As such, consumers applying through Heart Paydays may see differences in loan offers depending on local rules and compliance limitations.

For instance:

- California and New York have stricter caps on APR and require additional disclosures for short-term lending products.

- Texas and Florida, while offering broader loan access, allow higher maximum interest rates and more flexible installment terms.

- Ohio and Illinois have enacted borrower-friendly rules that limit predatory lending practices and enhance transparency in the loan process.

Applicants are encouraged to check their state-specific lending rules and disclosures before accepting any offer. Heart Paydays only partners with lenders who are fully licensed and compliant with state and federal regulations.

This regulatory landscape is part of why loan matching platforms like Heart Paydays are increasingly preferred: they help consumers navigate lender eligibility requirements across jurisdictions while minimizing unnecessary application attempts or declined offers.

July 2025 Summary

With rising costs and reduced savings rates, many Americans are relying on personal loans as financial bridges. Heart Paydays is helping thousands connect to more affordable solutions—with a focus on speed, simplicity, and credit accessibility.

Borrowers in 2025 are more informed, digitally savvy, and focused on transparency. Platforms like Heart Paydays will continue to meet these needs through expanded access, automated tools, and consumer-friendly lending models.

- Email: support@heartpaydays.com

Disclaimer and Disclosure

This article is for informational purposes only and does not constitute financial advice. Loan terms, availability, and approvals vary by lender and individual qualifications. Heart Paydays does not directly issue loans. This article may contain affiliate links, and a commission may be earned if a reader applies through one of these links. Readers should consult a financial advisor before making financial decisions.

Heart Paydays is not a lender. It acts solely as a connection service. Neither the author nor the publisher guarantees the accuracy of third-party information presented herein.

Email: support@heartpaydays.com